Simplifying the Medicare Supplement:

A Medicare Supplement Plan helps pay for some of what Original Medicare doesn’t cover, like copayments, deductibles, and coinsurance. These are commonly known as Medi-gap policies and are offered through private companies. There are 10 standardized Medicare Supplement Plans to choose from in 2020. Because Medicare Supplement Plans are standardized by CMS, all plans with the same letter will have the same coverage no matter which insurance company you select. Plans range from letters A-N and have different levels of coverage.

Medicare Supplement:

Many are surprised to learn that Medicare has large deductibles for hospital coverage and only covers 80% of Part B charges. For example, paying 20% of the cost for an ambulance and emergency room visit can be catastrophic to many Americans, especially those on a fixed income. This is one of the many reasons why Medicare Supplement Plans were introduced.

Medicare Supplement Plans make your payments for healthcare more predictable and give you peace of mind knowing you won’t be stuck with a large bill in an emergency.

Some of the primary advantages of a traditional Medicare supplement policy are:

- Freedom to choose your own doctors and hospitals**

- No referrals or prior authorization required to see a specialist

- Predictable out-of-pocket costs for Medicare-covered services

- Nationwide coverage

- Guaranteed renewability: you can never be dropped or have your coverage changed due to a health condition as long as you pay your premiums

- Standardized coverage: coverage levels will never change for the plan you choose

As you can see, the freedom to choose your physicians and stability in coverage are the main benefits of a Medicare Supplement Plan.

Important Medigap Facts:

- You must be enrolled in Medicare Parts A & B

- Plans do not include Part D coverage, you must add this separately

- There is no annual election period for Medigap, you can drop your plan anytime

- The annual election period is for Medicare Advantage and Part D plans

- Medicare is individual and so is your Medicare Supplement. You and your spouse will need to get a seperate plan.

- Many insurance companies offer a household discount

- Plan F will no longer be available to those turning 65 after January 1, 2020.

How Medicare Supplement coverage works:

Medicare Supplements are referred to as “Medicare Supplement” because they fill the gaps in your Medicare coverage. These gaps can include things like deductibles, coinsurance and copays. Medicare will pay its share of the Medicare-approved amount for covered health care costs and your Medicare Supplement pays what’s left.

You can use your plan at any provider that accepts Medicare. This makes Medicare supplements great for domestic travel or for those who live in more than one state throughout the year.

Medicare Supplement Plans do not include retail drug coverage, so you’ll want to purchase a standalone Part D drug plan for your medications. A Medicare Supplement does not cover routine dental, vision or hearing services either. Since Medicare doesn’t cover these items, your supplement can’t pay anything toward them either.

Example:

John is currently enrolled in Medicare and a Medicare Supplement Plan G and visits his primary doctor. His total Medicare-allowable rate is $1,000. Per Medicare guidelines, Part B has a deductible of $198, and will only cover 80% of the cost after the deductible is met. So, after Medicare pays its share, John is left with a $398 balance. But, John will only need to pay the $198 deductible because his Medicare Supplement Plan G covers 100% of any cost after this deductible is met. He will no longer have any Part B costs for the remainder of the year.

If John didn’t have Medicare Supplement Plan G, he’d be liable for the deductible of $198 and 20% of the remaining $1000 balance, which would be an additional $200 for a total of $398.

What are the Medicare Supplement Plans?

Each Medicare Supplement Plan has a letter assigned, A through N. Each letter represents a different amount of standardized coverage. So, all Plan G coverage will be the same no matter the insurance company you select. A United Healthcare Plan G has the same coverage as a Blue Shield Plan G.

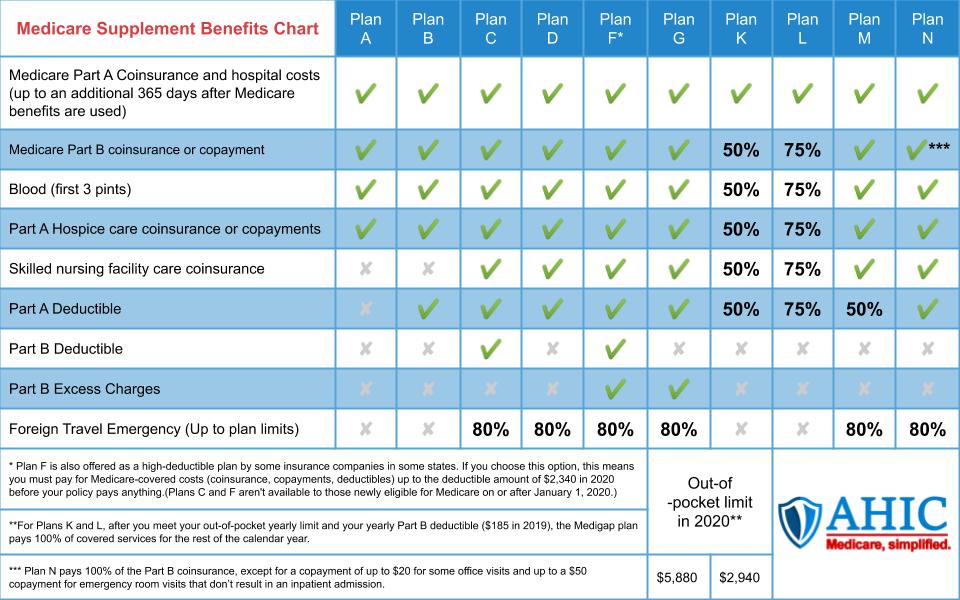

This Medicare supplement chart shows the 10 standardized plans. These plans are offered by insurance companies in most states.

How do I pick a Medicare Supplement plan?

With 10 plans and many companies offering Medicare Supplement Plans, finding the plan that’s right for you can be overwhelming. Most people choose plans F, G or N, simply because they offer the most coverage. Of course, you should make this decision based on your needs and budget not only now, but 10 or 20 years down the road.

Some people are willing to pay a higher premium so they can have peace of mind knowing all costs will be covered when something comes up. Others prefer a Medicare Supplement Plan that will cover only some of the out-of-pocket costs and deductibles in favor of a lower monthly premium.

There’s no wrong choice, only the choice that’s right for you.

How Much Do Medicare Supplements Cost?

Pricing varies by state, zip code, gender, tobacco use, and age. The cost of healthcare can vary greatly state-to-state, so you’ll find that some states are much more expensive than others.

For example: a Plan G for a turning-65 female, non-tobacco user, may cost around $115/month in California while the same policy would cost more than double in Florida. However, couples may benefit from household discounts. For quotes in your zip code, give us a call at +1 888-603-9445.

Medicare Supplement – Open Enrollment

During your Medicare Supplement open enrollment, you’ll have your choice of Medicare Supplement Plans. Whichever company you choose cannot ask you any medical questions, turn you down for any health conditions, or charge you any additional premium due to health conditions, medications or pre-existing illness.

Outside of this period, insurance companies can ask you medical questions, turn you down for health conditions, and charge you any additional premium due to health conditions, medications or pre-existing illnesses.

IMPORTANT:

The Annual Election Period that runs from October 15 – December 7 each year DOES NOT apply to Medicare Supplements and you CANNOT change your supplement without answering health questions. Many people mistakenly believe they can change their Medigap plan during this time. The Annual Election period applies only to Medicare Advantage and Part D plans.

Medicare Supplement: Medical Underwriting

If you missed your open enrollment period and do not qualify for guaranteed issue rights, you can still apply for a Medicare Supplement at any time. But, the insurance company can and will ask you health questions and potentially deny you for pre-existing conditions and illnesses.

Again, many believe the Annual Election Period that runs October 15 to December 7 allows them to change their Medicare Supplement Plans, but it doesn’t. You can only change your Medicare Advantage and drug plans during this period and not your Medicare Supplement Plan. Changing Medicare Supplement carriers will require underwriting in most cases.

Medicare Supplement: Guaranteed issue rights

Outside of your open enrollment period, an application for a Medicare Supplement usually needs to go through underwriting and may be denied. But, there are special circumstances that require an insurance company to sell you a Medicare Supplement policy, cover your pre-existing conditions, and cannot charge you a higher premium because of those pre-existing conditions. This is called your “guaranteed issue rights,” and should be seriously considered if you’re attempting to enroll in a Medicare Supplement Plan outside of open enrollment.

For example: If you’re in a Medicare Advantage Plan and your plan leaves Medicare, stops giving care in your area, or you move out of the plan’s service area, you’re entitled to guaranteed issue rights.

Speak with your AHIC agent to learn about all the potential situations that may give you guaranteed issue rights.

Do I really need supplemental insurance with Medicare?

Medicare Supplement insurance is optional. However, with Original Medicare Part A and Part B, you’re responsible for expensive hospital deductibles and copays, outpatient deductibles, and 20% of the cost of all outpatient services, including ambulance rides, surgeries and chemotherapy. Our agents understand that Medicare Supplement Plans may be out of reach for some financially. If this is your situation, consider a Medicare Advantage Plan. Medicare Advantage has lower premiums because you agree to use a local network of providers.

We’re on your side

Still have questions or need assistance with getting a Medicare Supplement quote? You’re not alone. AHIC is here to walk you through the process of applying for Medicare or shopping for the plan that’s right for you. Our services are free for you and we’ll be here to help for the lifetime of your policy.