Medicare Part D Coverage Gap Simplified.

What is the Part D Coverage Gap: Donut Hole 2020?

The coverage gap, commonly referred to as the donut hole, is a stage in the part D prescription drug plan that may limit the amount a plan is willing to cover. During this phase of the plan you may be expected to pay a higher amount for brand name and generic prescription drugs.

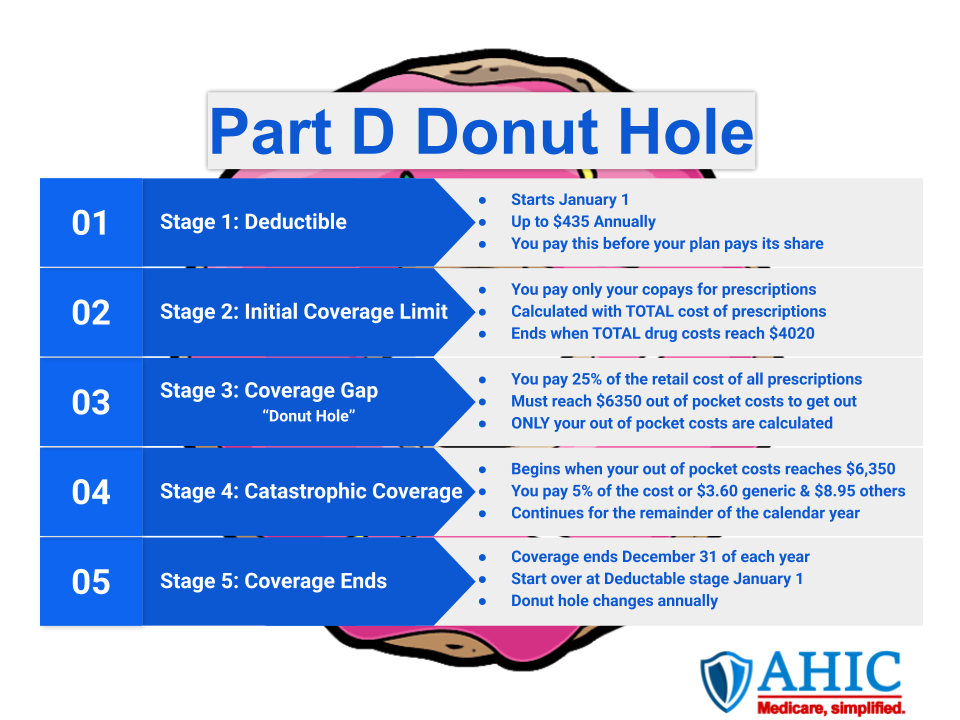

The illustration below will break down the part D coverage into 5 stages and how the coverage gap may affect your personal situation.

Medicare Coverage Gap In depth:

Stage 1: The deductible stage

It generally always starts on January 1. Now I know some of you may be enrolling into a part D plan for the first time here in the coming months so in that case the deductible stage would start on the 1st day you are effective with the Part D plan you are enrolled in and when the calendar is over it’ll start all over again on Jan 1. The deductible dollar amount on some plans may be as high as $435, meaning that you may be expected to come out of pocket for the total cost of the drugs until your out of pocket cost reaches $435.

Stage 2: The Initial Coverage Limit

The initial coverage limit amount for 2020 is $4,020. During this phase of the plan you are only responsible for set copays for your prescription drugs until the actual total cost of the prescription drug reaches $4,020. When we say total cost we are referring to what you pay in co-pays and what the plan pays per prescription drug. To explain this a little further please read the example below.

Example:

Let’s say you currently take a very expensive brand name drug and the plan has determined that your co-pay amount is $90 for a 30-day supply. We all know that the true cost of the drug isn’t $90, that’s just what your copay is during the initial coverage phase, the part D plan is actually picking up the rest of the cost. The true cost of that drug might be somewhere around $500 per 30-day supply, and that’s what the health plan is counting towards your initial coverage limit, the true cost of the drug. Your co-pay and what they pay.

Now when your total cost of prescription drugs reaches $4,020 you’ve now exhausted your initial coverage limit and have entered the Coverage Gap phase, also commonly known as the Donut Hole.

Stage 3: The Coverage Gap (Donut hole)

During this phase you pay a higher percentage for your prescription drugs, generally most plans may expect you to pay 25% of the cost of all name brand drugs and sometimes generic drugs too. So, adding to our previous example, that brand name drug that you originally had a $90 copay for may now cost you 25% of the total cost of the drug.

25% of $500 is $125, that’s what you would be expected to pay moving forward.

Now the coverage gap doesn’t last forever, the next phase of the Part D coverage is the Catastrophic phase.

Stage 4: The Catastrophic Phase

During this phase you pay the greater of 5% of the cost, or $3.60 copay for a generic drug and $8.95 copay for all other drugs. The catastrophic phase begins when your out of pocket drug costs reaches $6,350.

Let me repeat that, it’s “when your out of pocket drug costs reach $6,350”, meaning you won’t hit the catastrophic phase of the Part D plan until all your co-pay amounts add up to $6,350. Once you’re in the catastrophic phase, you’ll stay there until the end of the year December 31st and then the coverage phases will start all over again come January 1.

Stage 5: Coverage Ends

Coverage ends December 31st. Starting January 1st of the following year you’ll be back to the deductible stage.

Again, I know that was a lot of information and most people don’t fully understand it their first time around. We highly encourage you to set an appointment with a licensed AHIC agent to see if the donut hole or catastrophic phase will apply to you.

Still needs assistance?

Still have questions or need assistance with the Part D Donut Hole? You are not alone, AHIC is here to help. If you would like someone to walk you through the process of applying for Medicare, shopping for a plan, then please click on the link below. Our services are at NO COST to you and we will be here to help you for the lifetime of your policy.