Medicare Part B Simplified:

What is Medicare Part B?

Medicare Part B is medical insurance that helps pay for doctors and specialists, outpatient care, home health care, durable medical equipment, and some preventive services. The standard 2020 Part B monthly premium amount is $144.60 (or higher depending on your income). The Part B deductible for 2020 is $198 per year and once this deductible is met, you are responsible for 20% copay.

Medicare Part B In depth:

What is Covered by Medicare Part B?

Medicare Part B is medical insurance that covers 2 types of services:

Medically necessary services: Services or supplies that are needed to diagnose or treat your medical condition and that meet accepted standards of medical practice.

Preventive services: Health care to prevent illness (like the flu) or detect it at an early stage, when treatment is most likely to work best. Preventive services are generally fully covered as long as the provider accepts Medicare.

Below is a list of covered and not covered services under Medicare Part B.

Covered:

- Ambulance services

- Ambulatory surgical center fees

- Blood

- Cardiac rehabilitation–for certain situations

- Chiropractic services–for limited situations

- Chronic care management services

- Clinical research studies – some costs of certain care in approved studies

- Defibrillator (implantable automatic)

- Diabetic supplies

- Durable medical equipment – restricted to certain suppliers in some areas

- Emergency room services

- Eyeglasses after cataract surgery – limits apply

- Foot exams and treatment for certain diabetics

- Hearing and balance exams (no hearing aids) if needed for medical treatment

- Home health services in certain situations

- Kidney dialysis and disease education – certain situations

- Mental health care (outpatient) – limits apply

- Occupational and physical therapy – limits apply

- Pulmonary rehabilitation for COPD

- Prosthetic/Orthotic items

- Second surgical opinions

- Speech-language pathology services

- Telehealth services in some rural areas

- Tests like X-rays, MRIs, CT scans

- Transplant physician services and drugs

Not Covered by Medicare Part A & B

- Acupuncture

- Routine dental care/dentures

- Cosmetic surgery

- Custodial care

- Health care while traveling outside the US – exceptions apply

- Hearing aids

- Orthopedic shoes (with limited exceptions)

- Outpatient prescription drugs (this is covered under Part D)

- Routine foot care

- Routine eye care and eyeglasses

- Some screening tests and labs

- Vaccines, except as previously listed (those not covered under Part B are

- covered under Part D)

- Syringes and insulin unless used with an insulin pump (this is covered under Part D)

Medicare Part B generally covers anything that is deemed medically necessary by your doctor.

For example, Medicare does not cover routine screening tests for thyroid dysfunction or eye examinations for purposes of prescribing eyeglasses. However, Medicare may pay for eye exams that are part of the diabetes services benefit, a glaucoma test, or for macular degeneration.

While Medicare Part B does not cover some of these service like acupuncture, routine dental, hearing aids, ect. Medicare Advantage plans often do cover these services. To learn more about Medicare Advantage plans, get more information here: Medicare Advantage

What does Medicare Part B cost?

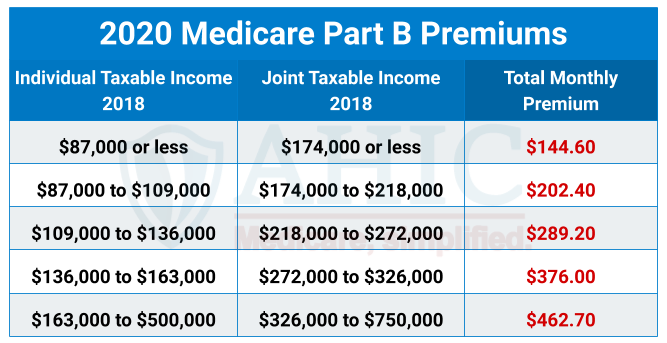

Medicare Part B is mainly funded by the monthly premium each Medicare beneficiary pays. Becuase of this, you must continue to pay your monthly premium in order to receive Part B benefits and stay enrolled. The standard 2020 Part B monthly premium amount is $144.60 (or higher depending on your income*). Your premium will be calculated using your reported income from 2 years prior. Social Security will automatically pull this information, calculate your premium, and let you know what your monthly premium will be. Your filing status will be taken into account but Medicare Part B premiums are always paid individually. So if you filed jointly, your premiums will be calculated as a whole but paid individually. See the chart below for the 2020 Medicare Premiums.

What am I responsible for under Medicare Part B?

The Part B deductible for 2020 is $198 per year. Once the deductible is met, you’re responsible for a 20% copay for any services billed under Part B.

- 2020 Part B deductible is $198

- 20% of any services billed under Part B, there are no limits or caps

- Additionally you may be billed for excess services rendered by provider or facility that go beyond what Medicare reimburses

What’s significant in Medicare Part B coverage is the 20% you could be liable for. Services such as a surgery or chemotherapy can add up quickly. Many people opt to shop for supplemental insurance to help with this 20%. There are Supplemental (Medigap) Plans and Medicare Advantage Plans for every budget to help reduce your risk.

How do I sign up for Part B?

If you’re taking Social Security income benefits at 65 or earlier, the Social Security office will automatically enroll you in Part B. Your card will arrive in the mail 1 to 3 months before your 65th birthday. Part B is elective, so you can opt out if you need to.

Otherwise, you’ll need to apply for Medicare Part B during your initial enrollment* (see below) period, which is 3 months before the month you turn 65, the month you turn 65, and the 3 months after. Applying for Medicare Part B can be done online, over the phone, or in person at your local Social Security office. After you apply, it can take 2 to 3 weeks for your card to arrive in the mail. AHIC agents recommend that you apply for Part B 3 months before the month you turn 65, to ensure you have enough time to get your card and check your options beyond Medicare.

*(Initial enrollment period)

It is very important that you apply for Part B at 65 unless you have credible employer coverage to avoid any Part B associated penalties. Find information on how to apply right below.

To apply for Medicare online, please visit this link: Medicare Benefits

To apply for Medicare by phone contact Social Security at 1-800-772-1213 ( for TTY users, it’s 1-800-325-0778) and let them know that you would like to apply for your Medicare benefits.

To apply for Medicare in person please visit your local Social Security office. If you need help locating the nearest office, please visit this link: Field Office Locator

For more information on each of these application options, visit: Apply for Medicare

Medicare Part B Late Enrollment Penalty:

Signing up for Medicare Part B when first eligible is crucial, unless you have credible employer coverage. If you don’t sign up during your 7 month initial enrollment period, you will be subject to the Medicare Part B late enrollment penalty. You will be penalized up to 10% for each 12-month period you could’ve had Part B. This penalty is added to your Part B premium every month for the remainder of your life.

When you enroll after your initial enrollment period, you’ll need to wait for the annual Medicare General Enrollment Period that runs from January 1 to March 31 to sign up for Part B. Your Part B will be effective the following July. Not only do you now have to pay a penalty, you’ll have to wait several months for your coverage to kick in.

If you’ve had employer group health coverage from a company with 20 or more employees, you will not be subject to the Medicare Part B late enrollment penalty. When you leave that coverage, you have 8 months to sign up for Part B. This is called your Special Enrollment Period for Medicare.

The best way to avoid the Medicare Part B late enrollment penalty is to enroll in Medicare during your Initial Enrollment Period. Your initial enrollment period begins 3 months before the month you turn 65, the month you turn 65, and 3 months after you turn 65.

Why should I sign up for Part B?

If you currently don’t have credible coverage through an employer or union and are turning 65, it’s highly recommended that you sign up for Part B to avoid late enrollment penalties.

If you’re still working and paying more than $144.60 per month for health insurance through your employer or union, you might want to consider enrolling in Medicare Part B and review your Medicare options with an AHIC agent. Your Medicare options might offer you greater coverage at a lower cost.

Please note that Covered California recipients will be expected to transition to Medicare once they turn 65. In general, people who are eligible for Medicare, even if they don’t enroll in it, aren’t eligible to receive financial help in the form of premium tax credits to lower the cost of a Covered California health plan.

People who are eligible for Medicare must report their Medicare eligibility to Covered California within 30 days, and will usually need to cancel Covered California. Your Covered California Plan won’t be automatically canceled when you become eligible for Medicare, even if you enroll in a Medicare plan with the same insurance company. You must cancel your plan yourself by contacting Covered California at least 14 days before you’d like your coverage to end.

If you’re eligible for Medicare, and you keep your Covered California Plan, you may face serious consequences. For example:

- You may have to pay back all or some of your premium tax credits to the Internal Revenue Service (IRS).

- There could be a delay in your Medicare coverage start date. If you don’t sign up for Medicare Part B during your initial enrollment period, you’ll have to wait for the general open enrollment period (Jan 1 to March 31), and your coverage won’t begin until July of that year.

We’re on Your Side

Still have questions or need assistance applying for your Medicare benefits? You’re not alone. AHIC is here to walk you through the process of applying for Medicare or shopping for the plan that’s right for you. Our services are free for you and we’ll be here to help for the lifetime of your policy.