Medicare Costs for 2020 Simplified:

Does Medicare cost anything? It does, and while most will pay the same for Medicare, others may have different costs for different reasons.

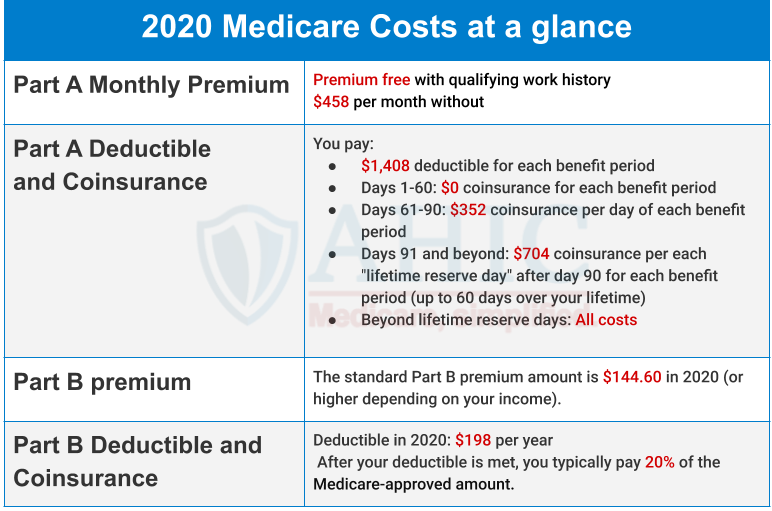

To make it easy, we’ve broken the costs for Part A and B below

The costs for Medicare Part D, Medicare Advantage, and Medicare Supplements will all vary for different reasons. Continue reading below for a breakdown of these costs.

Medicare Cost In Depth:

Medicare Part A in 2020

Medicare Part A for most people has a $0 premium. As long as you or your spouse has worked more than 10 years (40 quarters) in the United States, you qualify for free Part A. During your 10 years of work you’ll have paid enough Medicare taxes to pay for Part A. Nearly everyone eligible for Medicare has done this.

If you or your spouse have not worked for 10 or more years, you’ll have to buy Part A. The cost for Medicare Part A in 2020 is $458 per month. If you’ve worked less than 40 quarters, but more than 30 quarters, you can get a pro-rated premium for $252/month.

You must be a legal resident or have had a green card for at least 5 years.

Once you have Medicare Part A, you will have cost sharing if you are admitted as an inpatient.

You pay:

- $1,408 deductible for each benefit period

- Days 1-60: $0 coinsurance for each benefit period

- Days 61-90: $352 coinsurance per day of each benefit period

- Days 91 and beyond: $704 coinsurance per each “lifetime reserve day” after day 90 for each benefit period (up to 60 days over your lifetime)

- Beyond lifetime reserve days: All costs

Medicare Cost for Part B in 2020

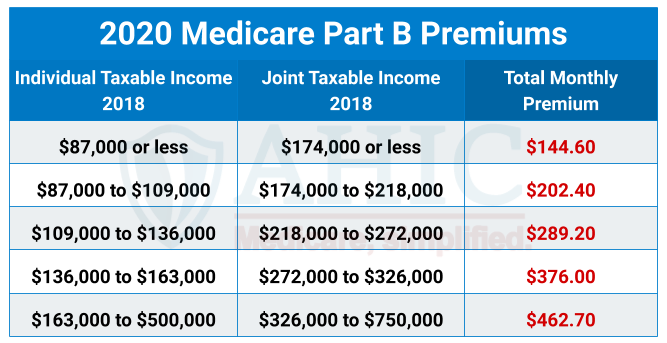

Medicare Part B premiums are based upon your modified adjusted household gross (MAGI) income from 2 years prior. The Social Security office will pull your IRS tax return from two years prior and use this to determine what your monthly premiums for Parts B.

Your filing status does affect how your premiums are calculated. For example, if you filed jointly, Social Security will use this to set you and your spouse’s Medicare Premiums INDIVIDUALLY. So, you will EACH pay your own Part B premium separately as Medicare is individual. You must continue to pay this premium to receive benefits. Social Security will usually notify you of your next year’s premium annually in December or early January by mail.

Medicare premiums are calculated on a sliding scale based on income and only about 5% of all Medicare beneficiaries currently pay higher Medicare premiums. See the chart below to see how Medicare premiums are calculated in 2020.

Take a closer look at what Part B covers and costs here.

Medicare Cost for Part D for 2020

Like Medicare Part B, your monthly premiums for Part D can vary based on income. You’ll have to purchase your part D as a standalone plan from a private insurance company or get it from a Medicare Advantage Plan. You’ll pay a premium for these plans, and you may have to pay an additional amount to Medicare if you’re a higher earner. Plans and premiums vary by area and there can be dozens of options with ranging premiums.

For most, you’ll just need to pay the stated premium of your Part D Plan. Take a look at our Part D premium chart to see if you will pay more for Part D in 2020.

You can learn more about Medicare Part D coverage and costs here.

How to pay for Medicare?

If you’ve signed up for Social Security income benefits, your Medicare premiums will be deducted from your Social Security payments monthly. If you haven’t taken your Social Security income benefits, Medicare will bill you quarterly.

How to lower your out of pocket costs?

With Medicare there is 2 options to help lower your out of pocket cost responsibilities for Part A and Part B.

The first and most common is a Medicare Supplement plan. The Medicare Supplement helps pay the deductibles and coinsurance that you are left with traditional Medicare. You get Medicare Supplements from private insurance companies that you pay a monthly premium for. For help selecting the correct Medicare Supplement we strongly advise working with an agent to get one that fits your needs and budget.

Find out more about Medicare Supplements here.

The second option, and rapidly growing in popularity, is Medicare Advantage. Medicare Advantage plans are plans offered by private insurance companies and regulated by the federal government to offer an alternative to Medicare. These plans are usually HMO and PPO options that require you to use a set network to receive your care. Medicare Advantage plans are often the lower cost alternative to Medicare and Medicare Supplements and often offer coverage for services Medicare usually does not cover. These can include vision, dental, hearing, transportation, fitness memberships and much more. Medicare Advantage plans differ from area to area. For help selecting the correct Medicare Advantage we strongly advise working with an agent to get one that fits your needs and budget.

Find out more about Medicare Advantage here.

We’re on Your Side

Still have questions or need assistance with calculating your Medicare costs? You’re not alone. AHIC is here to walk you through the process of applying for Medicare or shopping for the plan that’s right for you. Our services are free for you and we’ll be here to help for the lifetime of your policy.